“Confusion is the welcome mat at the door of creativity.” – Michael J. Gelb

We are all a bit confused. And for those of us – buyers, sellers, and intermediaries – that desire to pursue our goals of consummating transactions, it’s paramount that we try to understand our new reality as best as possible. The purpose of this post is to try to understand what may unfold in the small M&A markets (generally, transactions <$2MM) using historical examples and analysis. Knowing the challenges of the past should better allow us to foster the creativity necessary to overcome those challenges should they unfold again.

While we do not pretend to understand the full future impact of the current situation, we can gather clues from the past and present to help shape our idea about what the near and medium-term future may hold.

Looking At The Past: Q1 2009

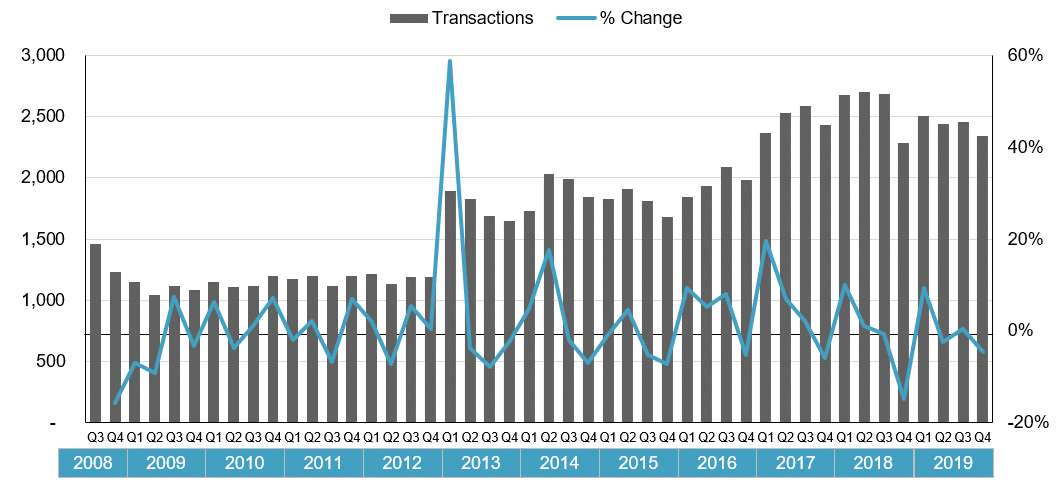

Let’s start in the first quarter of 2009, the first quarter where there was marked degradation of the small M&A markets after the Q4 2008 stock market crash. Covering an analysis by bizbuysell.com, the website gaebler.com noted, “The number of closed transactions reported by Bizbuysell.com in the First Quarter 2009 was down 36% as compared to the same time period in 2008.” While this is certainly a sharp drop, on the flip side, many transactions were still getting done.

Now, one might think initially that the reason was that buyers pulled back. While some certainly did, buyers pulling back was not a primary driver of the decline in transactions. The article goes on to quote Mike Handelsman, then General Manager at Bizbuysell.com: “Many business brokers are reporting a record level of buyer interest, but limited access to capital and uncertainty about the future have proven to be major barriers in deals getting off the ground and closed.”

Handelsman also highlighted, “Even though record levels of corporate layoffs have created tens of thousands of hopeful entrepreneurs, the decreasing sales prices and revenue and cash flow multiples make it clear that buyers are approaching deals with more caution than ever.”

The main themes of strong buyer interest, lack of banking support, degradation of buyer financial strength, increased due diligence investigation and declines in sale price multiples are repeated throughout the following 2009 quarterly reports.

Q3 2009

On October 6, 2009, approximately one year after the stock market crashed, bizbuysell.com reported: “After multiple quarters of declining business-for-sale transactions, the new numbers suggest that the state of the small business economy is finally beginning to improve.”

Mike Handelsman of BizBuySell.com noted: “As credit eases, business fundamentals recover and SBA lending criteria change with respect to goodwill, we are optimistic that the fourth quarter of this year and the first quarter of 2010 will show increased signs of recovery and growth.”

Q4 2009

Bizbuysell.com highlighted that, led by a resurgence in interest in service businesses and restaurants “a recovery that began mid-year continued to gain momentum in the Fourth Quarter.”

Prices began to recover and access to credit began loosening about this time. Bizbuysell.com predicted the following would result in a “consistent recovery” in the business-for-sale marketplace:

· Latent Supply. For the past 12-15 months, small business owners have focused on keeping their businesses afloat, and finding ways to earn a living, rather than focusing on a potential exit. That latent supply will begin to hit the for-sale market as the economy and prospects for finding motivated and qualified buyers improves.

· Unemployed Workers Seeking Jobs. With unemployment hovering above 10 percent in most markets, laid-off workers will increasingly look to “buy a job” by finding a small business to provide income.

· Easing Credit. With both supply and demand for small business transactions increasing, the remaining key ingredient to return the market to full health is the availability of purchase capital. The Federal Government and the SBA have been focused on helping banks ease their lending restrictions to provide the necessary capital to the small business market.

· Baby Boomer Retirees. In addition to the improving market dynamics of supply and demand, there is an ongoing macro trend of the U.S. baby boomer population reaching retirement age. As increasing numbers of small business owners near retirement, this trend will continue to bring above-average numbers of small businesses to the sale market.

Now, what is also interesting is that while the market stabilized throughout 2009, it’s not until the beginning of 2013 that we began to see a massive spike (59% increase) in transactions. This spike leads to a persistent trend of increases in small business sales.

The Recent Past: Q3 2019

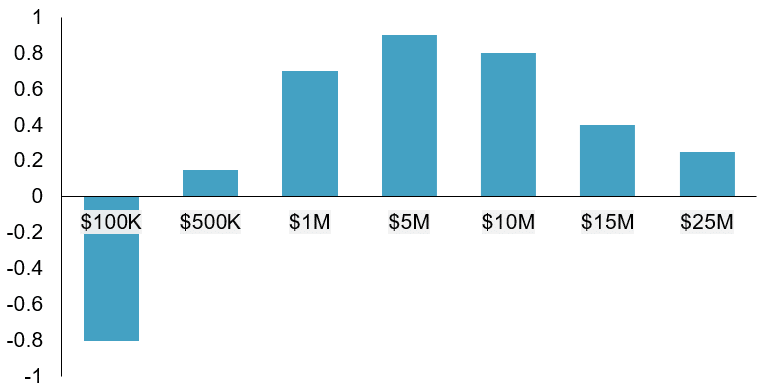

What is also interesting is that while the macro-trend, lead by baby boomer retirees, has remained largely intact, we started to see a slow decline starting in Q3 2019. In my opinion, this slowdown was spurred by the data we see regarding the difficulty in arranging debt and increase in time to purchase a small business. As shown by the chart below even prior to the recent crash the ease of arranging debt for the small businesses was already very difficult.

In closing, what do we expect heading throughout 2020 and into 2021? Based on this past study of the 2008-2009 Financial Crisis, we expect the following could reasonably happen:

· Small business transactions will decline by at least 25% over the next 12 months.

· Despite this, we do not expect that the number of closed deals will decline to 2009 levels. Larger trends such as Baby Boomers retiring will likely support (much) higher numbers of transactions than the averages of the years 2009-2012.

· Increased buyer and lender due diligence will lengthen the time it takes to close transactions. The time it took to close a deal has already increased, on average, 34% between 2013-2019. So, this trend was already in place.

· We expect that government stimulus will be stronger and faster and therefore access to credit may be more readily available, however, we anticipate that lenders will significantly pull back from transaction funding. We will note here that while generally aggressive prior to 2020, many lenders had already started becoming much more scrutinous of deals.

· While we do not expect unemployment levels to remain at potential record highs for long and believe that the number of unemployed will drop sharply after businesses are allowed to re-open, we do think that unemployment will remain high and that this will breed a new generation of entrepreneurs seeking to purchase a business.

What Needs To Happen To Get Transactions Across the Finish Line?

Many businesses and buyers will remain solid. Despite this, lender pullback and buyer concern over the future will result in requests for creativity in deal structuring. Buyers will increasingly request that sellers finance portions of the transaction or retain/roll equity. We will provide some examples of recent offers we have received that reflect this creativity entering the marketplace in subsequent blog posts. Additionally, we will provide some advice and guidance for those wishing to get deals done in 2020 and beyond.

In conclusion, we anticipate that many themes from the past may reveal themselves again as we head into the future. Now, certainly, there are characteristics of this present crisis that prospectively bode well for business transactions and potentially a faster recovery but it is still prudent to draw similarities to the last time the country faced dour times.

The main themes of strong buyer interest driven by changing circumstances including unemployment, changing awareness and presentation of opportunities, cautious banking support and increased due diligence investigation will likely permeate the deal market. Additionally, the broader trend of Baby Boomer retirement and burnout will likely continue to foster more business opportunities than we saw from 2009-2012.

Our team hopes and prays for a fast recovery and for many holistically successful transitions for years to come!